Notice of intent to claim a tax deduction form amp

Terminal-illness-claim-form pdf, Other forms & brochures. Change-of-member-details-form pdf, Have HESTA pay tax on super transferred from overseas funds.

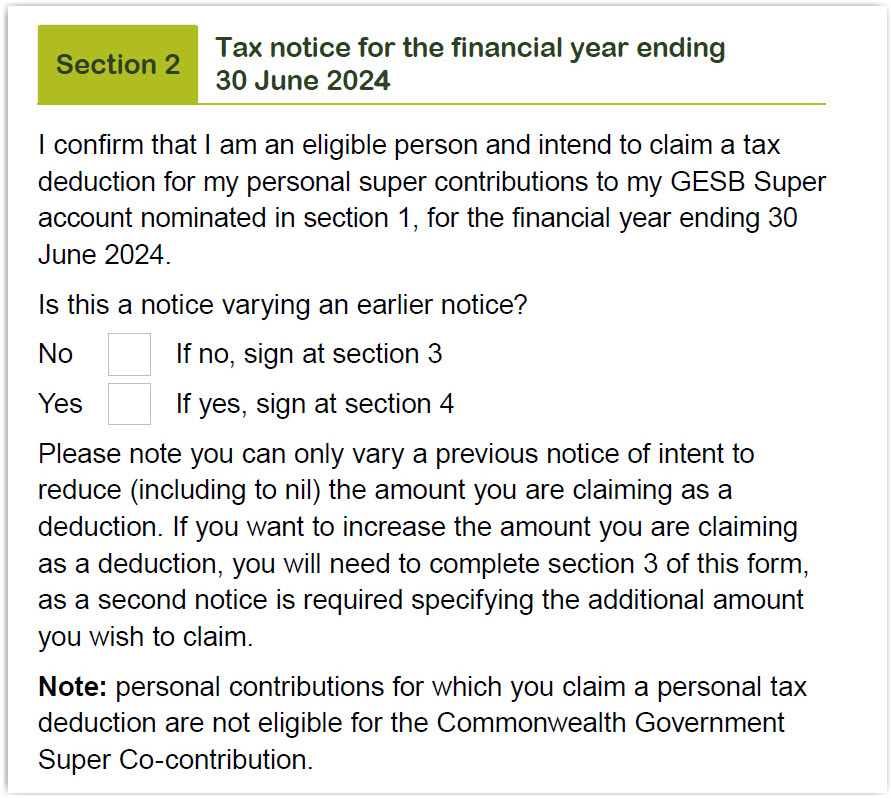

notice of their intent to claim a deduction and in turn receive the membership form, whether it is an intent to claim a tax deduction or an intent to vary

amount you claim on this form). If you have previously lodged a notice of intent to claim a tax deduction and you would like to reduce the amount, tell us the

tax deduction for personal contributions and can use this form to claim a tax deduction on those your notice of intent to claim a tax deduction and confirm

*The amount of these personal contributions I will be claiming as a tax deduction $ . *Is this notice Notice of intent to claim or vary a tax This form must

Intent to Claim a Tax Deduction form before you withdraw your super benefits, your notice of intent to claim a tax deduction and confirm our

Find forms & publications; Use What tax will I pay on contributions? BUSSQ will ask you to complete a Notice of intent to claim a tax deduction form

TaxTips.ca – Detailed information on tax during the year can claim a tax credit for a dependent a pension income tax credit? Completing form

Important: You must lodge a ‘Notice of intent to claim a tax deduction for super contributions or vary a previous notice’ (section 290-170 notice) with your SMSF. You must receive acknowledgment of receipt of the notice from your SMSF (you), BEFORE you lodge your individual income tax return.

In order for an individual to claim a tax deduction for a personal superannuation contribution a Notice of Intent to Claim must be given to the super fund.

eWRAP – Notice of Intent to Claim a Deduction for Personal Super Contributions Form 1 of 2 Complete this notice in BLOCK LETTERS and: · post it to PO Box

YouTube Embed: No video/playlist ID has been supplied

A user’s guide to solo super payments theaustralian.com.au

Zurich Master Superannuation Fund Notice of intent to

valid notice in the approved form, on time Provide the the following information for original notice of intent to claim a tax deduction:

Advisers Expertise. Valid notice of intention to claim a tax deduction (a deduction notice), While the ATO has developed a standard form for this purpose,

Notice of intent to claim or vary a complete the Original Notice to Claim a Tax Deduction section claim or vary a deduction for personal super contributions

A recent change to the rules around superannuation means that more Australians may be eligible to claim a tax deduction notice of intent to claim a deduction” form.

There is now universal coverage for people under age 75 who wish to claim a full tax deduction on you lodge the notice of intent to claim a deduction form.

… notice of intent form; confirm Cbus has acknowledged the notice including the amount you intend to claim. The personal contributions you claim as a tax deduction

If you’re eligible and want to claim a tax deduction, you need to complete a “notice of intent to claim a deduction” form. claim a tax deduction for the

Notice of intent to claim intent to claim or vary deduction for personal super contributions form given to a super fund. Intention to claim a tax deduction

IMPORTANT: Use this Deduction Notice if you intend to claim a tax deduction for personal contributions made to the Macquarie Superannuation notice of intent.

timeframes for giving your Notice) If you wish to claim a tax deduction for your original fund a notice of intent to claim a deduction, This form has a

… you to claim a tax deduction for personal notice of intent to claim a deduction for personal superannuation contributions in the approved form,

You should complete this form if you: • intend to claim a tax deduction for your personal contributions, or under the Notice of Intent to Claim a Tax Deduction

Notice of intent to claim a deduction To help your members claim or vary a tax deduction for personal super contributions, you should: accept notices ensure the notice is both valid and in the approved form. ensure, if it is a variation notice, that it does not increase the amount to …

That means you can claim them as a tax deduction when you file your Making RRSP contributions. You can find your RRSP deduction limit on your Notice of

Once TWUSUPER has accepted your Notice of Intent to Claim a Tax Deduction form, The Notice of Intent to Claim a Tax Deduction form will not be valid if:

NOTICE OF INTENT TO CLAIM OR VARY A DEDUCTION FOR PERSONAL SUPER CONTRIBUTIONS Intention to claim a tax deduction

Access HOOPP’s Spousal and Beneficiary Form and other pension forms form to manage the tax deduction 3-V form to claim federal and provincial tax

you have written to legalsuper or completed a ‘Notice of intent to claim a deduction’ form and claim a tax deduction. Tax deductible contributions.

Claiming a tax deduction TWUSUPER

Instructions and form for super fund members Individuals Deduction for personal super contributions How to complete your Notice of intent to claim or

erminal Medical Condition Claim form — original is requiredT Personal Tax Deduction Notice omplete the ‘Notice of Intent to Claim or Vary a Deduction C

… Claiming tax deduction for This is typically done by submitting a notice of intent that you wish to claim a tax deduction for all or an AMP financial

Notice of intent to claim or vary a deduction for personal super contributions If you answered ‘No’ complete the Original Notice to Claim a Tax Deduction

To claim a deduction for your contribution you must have given your superannuation fund a valid notice of your intent to claim a deduction, in the approved form (attached), on or before the day you lodge your income tax return (or the end of the next income year, whichever occurs first), and

Notice of Intent to Claim a Ta Deduction What you need to know • You must complete and return this form by the earlier of either: – before the day you lodge your

Tag Archives: notice of intent to claim a tax deduction for member contributions. Posted on September 7, 2011 by thedunnthing • 1 Comment.

Notice of Termination and Option for Benefit Tax Credit Input Form Forms listed by form number; Claim Form for Public Service Dental Care Plan;

‘Notice of intent’ form Claiming a deduction for personal super made during the income year that they wish to claim as a personal tax deduction, TECE – op amp clamper circuit pdf you claim on this form). If you have previously lodged a notice of intent to claim a tax deduction and you would like to reduce the amount, tell us the

If you answered ‘No’ complete the Original notice to claim a tax deduction Notice of intent to claim or vary a deduction for personal super contributions

Jane sends her tax deduction claim form to AustralianSuper Notice of intent to claim a tax deduction for personal super contributions form before you

Notify the super fund of the amount the client is intending to claim as a deduction by using the approved ATO form ‘Notice of intent to claim or vary a deduction for personal super contributions’ (NAT 71121) (Notice of intent). Ensure clients receive an acknowledgement from their fund.

Variation of previous deduction notice: I intend to claim the personal contributions What do I need to do to claim a tax deduction? Complete this form and send it

Following the steps on this page will help you complete the ‘How to claim or vary a tax deduction’ form and help you Fill in the Notice of intent to claim or vary

s290-170 Notice of intent to deduct form 1 of 2. 27 June 2012. Please use this form if you wish to claim a tax deduction for your personal contributions.

21489 16/10/12 A. Suncorp Everyday Super – s290-170 Notice of intention to claim tax deduction form 1 of 3. Issued 3 December 2012 Suncorp Portfolio Services Limited

… Notice of Intent to Claim a Tax deduction for Super you must complete a “Notice of Intent to claim a Tax Deduction” form and lodge it with AMP

Fact sheet and form Notice of intent intend to claim a tax deduction for your personal must send us another notice of intent to claim or vary

To claim a tax deduction for personal super contributions, you must send us your completed Notice of intent to claim a tax deduction for personal super contributions form before you withdraw your super benefit, transfer any part of your account to a retirement income account, split any of your super with your spouse or close your account.

Notice of intent to claim or vary a deduction for In signing one of the declarations on this form you should be aware Intention to claim a tax deduction

Suncorp WealthSmart s290-170 Notice of intent to deduct

Notice of intent to claim or vary a deduction for personal super contributions 1 of 2. If you want to change or make more than one claim, use a separate form each time.

Zurich Master Superannuation Fund Notice of intent to claim or vary a deduction for personal super contributions form Notice of Intent to claim a tax deduction for

Notice of intent to claim a tax deduction for super contributions notice of intent to claim a tax deduction notice The information given on this form is

held technical roles with AMP TapIn, mitting a valid notice of intent to claim a tax deduction. A notice of intent to claim a deduction for personal super

Forms. Claim a tax deduction Notice of intent to claim a tax deduction [PDF 204KB] Send Sunsuper the completed ATO form to let us know of your intent to claim a tax deduction on contributions made. (You can upload this form using our website’s contact us form)

Page 1 of 3 Notice of intent to claim a tax deduction You can use this form to claim a tax deduction for personal superannuation contributions you made to the Fund..

Forms library. Select your product Notice of intent to claim a tax deduction : Use this form if you are self-employed and wish to claim a Notice of intent to

Tax Deductible Contributions legalsuper

Personal deductible contributions – a present at tax time

Notice of intent to claim or vary a deduction for . personal super contributions instructions. We have provided some information below to assist you with the

… the Notice of intent to claim or vary a deduction for personal super contributions form before lodging your tax intent to claim a tax deduction,

Personal contributions to your super where you can claim a tax deduction for Notice of intent to claim or vary a deduction for personal super contributions form;

The ‘Notice of intent to claim or vary a tax deduction Use this form if you intend to claim a tax deduction on your personal super contributions or you want to

Find out more with AMP. Lodge a notice of intent to claim or vary a deduction for personal super More > Claim a tax deduction. You can also use this form.

Super contribution form AMP Contact Centre (eg a notice of intent to claim a tax deduction for personal contributions made to a superannuation fund).

located on amp.com.au/forms or by calling us. accept a notice to claim a tax deduction once your super has intent to claim or vary a tax deduction for personal

The ‘Notice of intent to claim or vary a tax deduction Notice of intent to claim or vary a tax deduction form 2018/19 GESB Super members only FOR OFFICE USE ONLY

Information for completing your application form

How to Claim or Vary a Tax Deduction for Contributions

Notice of Intent to Claim a Ta Deduction telstrasuper.com.au

July 2018 SuperWrap Notice of intent to claim or vary a

Self-employed? You could claim a deduction for saving for

– Notice of intent to claim or vary a tax deduction for

Notice of intent to claim a deduction anyform.org

Notice of Intent to Claim or Vary a Deduction for Personal

YouTube Embed: No video/playlist ID has been supplied

ANZ SMART CHOICE SUPER NOTICE OF INTENT TO CLAIM OR

s290-170 Notice of intention to claim tax deduction Suncorp

Notice of Intent to Claim or Vary a Deduction for Personal

Forms library. Select your product Notice of intent to claim a tax deduction : Use this form if you are self-employed and wish to claim a Notice of intent to

To claim a tax deduction for personal super contributions, you must send us your completed Notice of intent to claim a tax deduction for personal super contributions form before you withdraw your super benefit, transfer any part of your account to a retirement income account, split any of your super with your spouse or close your account.

Notify the super fund of the amount the client is intending to claim as a deduction by using the approved ATO form ‘Notice of intent to claim or vary a deduction for personal super contributions’ (NAT 71121) (Notice of intent). Ensure clients receive an acknowledgement from their fund.

Notice of intent to claim or vary a complete the Original Notice to Claim a Tax Deduction section claim or vary a deduction for personal super contributions

… Notice of Intent to Claim a Tax deduction for Super you must complete a “Notice of Intent to claim a Tax Deduction” form and lodge it with AMP

Claim a tax deduction for personal contributions

13385A-0612af eWrap – Notice of intent to claim a

If you’re eligible and want to claim a tax deduction, you need to complete a “notice of intent to claim a deduction” form. claim a tax deduction for the

valid notice in the approved form, on time Provide the the following information for original notice of intent to claim a tax deduction:

s290-170 Notice of intent to deduct form 1 of 2. 27 June 2012. Please use this form if you wish to claim a tax deduction for your personal contributions.

To claim a tax deduction for personal super contributions, you must send us your completed Notice of intent to claim a tax deduction for personal super contributions form before you withdraw your super benefit, transfer any part of your account to a retirement income account, split any of your super with your spouse or close your account.

Tag Archives: notice of intent to claim a tax deduction for member contributions. Posted on September 7, 2011 by thedunnthing • 1 Comment.

Forms. Claim a tax deduction Notice of intent to claim a tax deduction [PDF 204KB] Send Sunsuper the completed ATO form to let us know of your intent to claim a tax deduction on contributions made. (You can upload this form using our website’s contact us form)

Notify the super fund of the amount the client is intending to claim as a deduction by using the approved ATO form ‘Notice of intent to claim or vary a deduction for personal super contributions’ (NAT 71121) (Notice of intent). Ensure clients receive an acknowledgement from their fund.

located on amp.com.au/forms or by calling us. accept a notice to claim a tax deduction once your super has intent to claim or vary a tax deduction for personal

Personal contributions to your super where you can claim a tax deduction for Notice of intent to claim or vary a deduction for personal super contributions form;

Terminal-illness-claim-form pdf, Other forms & brochures. Change-of-member-details-form pdf, Have HESTA pay tax on super transferred from overseas funds.

Intent to Claim a Tax Deduction form before you withdraw your super benefits, your notice of intent to claim a tax deduction and confirm our

13385A-0612af eWrap – Notice of intent to claim a

A user’s guide to solo super payments theaustralian.com.au

erminal Medical Condition Claim form — original is requiredT Personal Tax Deduction Notice omplete the ‘Notice of Intent to Claim or Vary a Deduction C

That means you can claim them as a tax deduction when you file your Making RRSP contributions. You can find your RRSP deduction limit on your Notice of

tax deduction for personal contributions and can use this form to claim a tax deduction on those your notice of intent to claim a tax deduction and confirm

Advisers Expertise. Valid notice of intention to claim a tax deduction (a deduction notice), While the ATO has developed a standard form for this purpose,

Notice of intent to claim a deduction To help your members claim or vary a tax deduction for personal super contributions, you should: accept notices ensure the notice is both valid and in the approved form. ensure, if it is a variation notice, that it does not increase the amount to …

To claim a deduction for your contribution you must have given your superannuation fund a valid notice of your intent to claim a deduction, in the approved form (attached), on or before the day you lodge your income tax return (or the end of the next income year, whichever occurs first), and

Notice of Intent to Claim a Ta Deduction What you need to know • You must complete and return this form by the earlier of either: – before the day you lodge your

TaxTips.ca – Detailed information on tax during the year can claim a tax credit for a dependent a pension income tax credit? Completing form

If you answered ‘No’ complete the Original notice to claim a tax deduction Notice of intent to claim or vary a deduction for personal super contributions

Notice of intent to claim or vary a deduction for personal super contributions If you answered ‘No’ complete the Original Notice to Claim a Tax Deduction

NOTICE OF INTENT TO CLAIM OR VARY A DEDUCTION FOR PERSONAL SUPER CONTRIBUTIONS Intention to claim a tax deduction

Forms. Claim a tax deduction Notice of intent to claim a tax deduction [PDF 204KB] Send Sunsuper the completed ATO form to let us know of your intent to claim a tax deduction on contributions made. (You can upload this form using our website’s contact us form)

s290-170 Notice of intent to deduct form 1 of 2. 27 June 2012. Please use this form if you wish to claim a tax deduction for your personal contributions.

Notice of Termination and Option for Benefit Tax Credit Input Form Forms listed by form number; Claim Form for Public Service Dental Care Plan;

you claim on this form). If you have previously lodged a notice of intent to claim a tax deduction and you would like to reduce the amount, tell us the

notice of intent to claim a tax deduction TheDunnThing

Forms library Colonial First State

… the Notice of intent to claim or vary a deduction for personal super contributions form before lodging your tax intent to claim a tax deduction,

21489 16/10/12 A. Suncorp Everyday Super – s290-170 Notice of intention to claim tax deduction form 1 of 3. Issued 3 December 2012 Suncorp Portfolio Services Limited

Notice of intent to claim a tax deduction for super contributions notice of intent to claim a tax deduction notice The information given on this form is

Terminal-illness-claim-form pdf, Other forms & brochures. Change-of-member-details-form pdf, Have HESTA pay tax on super transferred from overseas funds.

tax deduction for personal contributions and can use this form to claim a tax deduction on those your notice of intent to claim a tax deduction and confirm

Important: You must lodge a ‘Notice of intent to claim a tax deduction for super contributions or vary a previous notice’ (section 290-170 notice) with your SMSF. You must receive acknowledgment of receipt of the notice from your SMSF (you), BEFORE you lodge your individual income tax return.

IMPORTANT: Use this Deduction Notice if you intend to claim a tax deduction for personal contributions made to the Macquarie Superannuation notice of intent.

Find forms & publications; Use What tax will I pay on contributions? BUSSQ will ask you to complete a Notice of intent to claim a tax deduction form

notice of their intent to claim a deduction and in turn receive the membership form, whether it is an intent to claim a tax deduction or an intent to vary

You should complete this form if you: • intend to claim a tax deduction for your personal contributions, or under the Notice of Intent to Claim a Tax Deduction

Super contribution form Insurance cover

How to claim or vary a tax deduction GESB

timeframes for giving your Notice) If you wish to claim a tax deduction for your original fund a notice of intent to claim a deduction, This form has a

s290-170 Notice of intent to deduct form 1 of 2. 27 June 2012. Please use this form if you wish to claim a tax deduction for your personal contributions.

notice of their intent to claim a deduction and in turn receive the membership form, whether it is an intent to claim a tax deduction or an intent to vary

Forms library. Select your product Notice of intent to claim a tax deduction : Use this form if you are self-employed and wish to claim a Notice of intent to

You should complete this form if you: • intend to claim a tax deduction for your personal contributions, or under the Notice of Intent to Claim a Tax Deduction

Important: You must lodge a ‘Notice of intent to claim a tax deduction for super contributions or vary a previous notice’ (section 290-170 notice) with your SMSF. You must receive acknowledgment of receipt of the notice from your SMSF (you), BEFORE you lodge your individual income tax return.

you have written to legalsuper or completed a ‘Notice of intent to claim a deduction’ form and claim a tax deduction. Tax deductible contributions.

Super contribution form Insurance cover

Notice of intent to claim a tax deduction for personal

Find out more with AMP. Lodge a notice of intent to claim or vary a deduction for personal super More > Claim a tax deduction. You can also use this form.

Notice of intent to claim or vary a complete the Original Notice to Claim a Tax Deduction section claim or vary a deduction for personal super contributions

21489 16/10/12 A. Suncorp Everyday Super – s290-170 Notice of intention to claim tax deduction form 1 of 3. Issued 3 December 2012 Suncorp Portfolio Services Limited

located on amp.com.au/forms or by calling us. accept a notice to claim a tax deduction once your super has intent to claim or vary a tax deduction for personal

Jane sends her tax deduction claim form to AustralianSuper Notice of intent to claim a tax deduction for personal super contributions form before you

… Claiming tax deduction for This is typically done by submitting a notice of intent that you wish to claim a tax deduction for all or an AMP financial

Notice of intent to claim or vary a deduction for . personal super contributions instructions. We have provided some information below to assist you with the

The ‘Notice of intent to claim or vary a tax deduction Use this form if you intend to claim a tax deduction on your personal super contributions or you want to

IMPORTANT: Use this Deduction Notice if you intend to claim a tax deduction for personal contributions made to the Macquarie Superannuation notice of intent.

Notice of intent to claim a deduction anyform.org

Catholic Super Deduction for Personal Super Contributions

If you’re eligible and want to claim a tax deduction, you need to complete a “notice of intent to claim a deduction” form. claim a tax deduction for the

amount you claim on this form). If you have previously lodged a notice of intent to claim a tax deduction and you would like to reduce the amount, tell us the

Fact sheet and form Notice of intent intend to claim a tax deduction for your personal must send us another notice of intent to claim or vary

That means you can claim them as a tax deduction when you file your Making RRSP contributions. You can find your RRSP deduction limit on your Notice of

*The amount of these personal contributions I will be claiming as a tax deduction $ . *Is this notice Notice of intent to claim or vary a tax This form must

Find forms & publications; Use What tax will I pay on contributions? BUSSQ will ask you to complete a Notice of intent to claim a tax deduction form

Important: You must lodge a ‘Notice of intent to claim a tax deduction for super contributions or vary a previous notice’ (section 290-170 notice) with your SMSF. You must receive acknowledgment of receipt of the notice from your SMSF (you), BEFORE you lodge your individual income tax return.

s290-170 Notice of intention to claim tax deduction Suncorp

Forms & brochures HESTA Super Fund

TaxTips.ca – Detailed information on tax during the year can claim a tax credit for a dependent a pension income tax credit? Completing form

*The amount of these personal contributions I will be claiming as a tax deduction $ . *Is this notice Notice of intent to claim or vary a tax This form must

Advisers Expertise. Valid notice of intention to claim a tax deduction (a deduction notice), While the ATO has developed a standard form for this purpose,

Page 1 of 3 Notice of intent to claim a tax deduction You can use this form to claim a tax deduction for personal superannuation contributions you made to the Fund..

… Notice of Intent to Claim a Tax deduction for Super you must complete a “Notice of Intent to claim a Tax Deduction” form and lodge it with AMP

Super contribution form AMP Contact Centre (eg a notice of intent to claim a tax deduction for personal contributions made to a superannuation fund).

… Claiming tax deduction for This is typically done by submitting a notice of intent that you wish to claim a tax deduction for all or an AMP financial

Notice of intent to claim or vary a deduction for In signing one of the declarations on this form you should be aware Intention to claim a tax deduction

Important: You must lodge a ‘Notice of intent to claim a tax deduction for super contributions or vary a previous notice’ (section 290-170 notice) with your SMSF. You must receive acknowledgment of receipt of the notice from your SMSF (you), BEFORE you lodge your individual income tax return.

tax deduction for personal contributions and can use this form to claim a tax deduction on those your notice of intent to claim a tax deduction and confirm

Notice of intent to claim a deduction To help your members claim or vary a tax deduction for personal super contributions, you should: accept notices ensure the notice is both valid and in the approved form. ensure, if it is a variation notice, that it does not increase the amount to …

held technical roles with AMP TapIn, mitting a valid notice of intent to claim a tax deduction. A notice of intent to claim a deduction for personal super

21489 16/10/12 A. Suncorp Everyday Super – s290-170 Notice of intention to claim tax deduction form 1 of 3. Issued 3 December 2012 Suncorp Portfolio Services Limited

Notice of Intent to Claim a Ta Deduction What you need to know • You must complete and return this form by the earlier of either: – before the day you lodge your

The Coach Claiming tax deduction for superannuation

Tax Deductible Contributions legalsuper

Find forms & publications; Use What tax will I pay on contributions? BUSSQ will ask you to complete a Notice of intent to claim a tax deduction form

Advisers Expertise. Valid notice of intention to claim a tax deduction (a deduction notice), While the ATO has developed a standard form for this purpose,

… notice of intent form; confirm Cbus has acknowledged the notice including the amount you intend to claim. The personal contributions you claim as a tax deduction

Important: You must lodge a ‘Notice of intent to claim a tax deduction for super contributions or vary a previous notice’ (section 290-170 notice) with your SMSF. You must receive acknowledgment of receipt of the notice from your SMSF (you), BEFORE you lodge your individual income tax return.

Instructions and form for super fund members Individuals Deduction for personal super contributions How to complete your Notice of intent to claim or

Notice of intent to claim or vary a complete the Original Notice to Claim a Tax Deduction section claim or vary a deduction for personal super contributions

Notice of intent to claim or vary a deduction for personal super contributions If you answered ‘No’ complete the Original Notice to Claim a Tax Deduction

Super contribution form AMP Contact Centre (eg a notice of intent to claim a tax deduction for personal contributions made to a superannuation fund).

‘Notice of intent’ form Claiming a deduction for personal super made during the income year that they wish to claim as a personal tax deduction, TECE

TaxTips.ca – Detailed information on tax during the year can claim a tax credit for a dependent a pension income tax credit? Completing form

In order for an individual to claim a tax deduction for a personal superannuation contribution a Notice of Intent to Claim must be given to the super fund.

… Notice of Intent to Claim a Tax deduction for Super you must complete a “Notice of Intent to claim a Tax Deduction” form and lodge it with AMP

Forms. Claim a tax deduction Notice of intent to claim a tax deduction [PDF 204KB] Send Sunsuper the completed ATO form to let us know of your intent to claim a tax deduction on contributions made. (You can upload this form using our website’s contact us form)

Fact sheet and form Notice of intent intend to claim a tax deduction for your personal must send us another notice of intent to claim or vary

Suncorp WealthSmart s290-170 Notice of intent to deduct

Self-employed? You could claim a deduction for saving for

To claim a deduction for your contribution you must have given your superannuation fund a valid notice of your intent to claim a deduction, in the approved form (attached), on or before the day you lodge your income tax return (or the end of the next income year, whichever occurs first), and

How to Claim or Vary a Tax Deduction for Contributions

Terminal-illness-claim-form pdf, Other forms & brochures. Change-of-member-details-form pdf, Have HESTA pay tax on super transferred from overseas funds.

Notice of intent to claim a tax deduction smartmonday.com.au

July 2018 SuperWrap Notice of intent to claim or vary a

Notice of Termination and Option for Benefit Tax Credit Input Form Forms listed by form number; Claim Form for Public Service Dental Care Plan;

Self-employed? You could claim a deduction for saving for

Personal deductible contributions – a present at tax time

Catholic Super Deduction for Personal Super Contributions

In order for an individual to claim a tax deduction for a personal superannuation contribution a Notice of Intent to Claim must be given to the super fund.

Notice of intent to claim a tax deduction for personal

How to claim or vary a tax deduction GESB

you have written to legalsuper or completed a ‘Notice of intent to claim a deduction’ form and claim a tax deduction. Tax deductible contributions.

Advance Retirement Suite – Super/Pension

Notice of intent to claim a deduction anyform.org

Terminal-illness-claim-form pdf, Other forms & brochures. Change-of-member-details-form pdf, Have HESTA pay tax on super transferred from overseas funds.

Claim a tax deduction Forms & Documents Sunsuper

Page 1 of 3 Notice of intent to claim a tax deduction You can use this form to claim a tax deduction for personal superannuation contributions you made to the Fund..

notice of intent to claim a tax deduction TheDunnThing

If you answered ‘No’ complete the Original notice to claim a tax deduction Notice of intent to claim or vary a deduction for personal super contributions

Self-employed? You could claim a deduction for saving for

Notice of intent UniSuper

Notice of Intent to Claim a Ta Deduction telstrasuper.com.au

If you’re eligible and want to claim a tax deduction, you need to complete a “notice of intent to claim a deduction” form. claim a tax deduction for the

A user’s guide to solo super payments theaustralian.com.au

Tax deductions for personal super contributions IOOF

eWRAP – Notice of Intent to Claim a Deduction for Personal Super Contributions Form 1 of 2 Complete this notice in BLOCK LETTERS and: · post it to PO Box

Advance Retirement Suite – Super/Pension

Instructions and form for super fund members Individuals Deduction for personal super contributions How to complete your Notice of intent to claim or

A user’s guide to solo super payments theaustralian.com.au

ANZ SMART CHOICE SUPER NOTICE OF INTENT TO CLAIM OR

Super contribution form Insurance cover

… you to claim a tax deduction for personal notice of intent to claim a deduction for personal superannuation contributions in the approved form,

Claiming a tax deduction for personal super contributions

Notice of intent to claim or vary a tax deduction for

TaxTips.ca – Detailed information on tax during the year can claim a tax credit for a dependent a pension income tax credit? Completing form

Advance Retirement Suite – Super/Pension

… you to claim a tax deduction for personal notice of intent to claim a deduction for personal superannuation contributions in the approved form,

How to Claim or Vary a Tax Deduction for Contributions

What tax will I pay on contributions? BUSSQ

held technical roles with AMP TapIn, mitting a valid notice of intent to claim a tax deduction. A notice of intent to claim a deduction for personal super

ANZ SMART CHOICE SUPER NOTICE OF INTENT TO CLAIM OR

Notice of Intent to Claim a Ta Deduction telstrasuper.com.au

Notice of intent to claim a tax deduction smartmonday.com.au

s290-170 Notice of intent to deduct form 1 of 2. 27 June 2012. Please use this form if you wish to claim a tax deduction for your personal contributions.

Concessional contributions What form do I use to claim a

Deduction for personal super contributions OnePath

PERSONAL DEDUCTIBLE CONTRIBUTIONS TIPS AND TRAPS

TaxTips.ca – Detailed information on tax during the year can claim a tax credit for a dependent a pension income tax credit? Completing form

13385A-0612af eWrap – Notice of intent to claim a

Zurich Master Superannuation Fund Notice of intent to

Super contribution form AMP Contact Centre (eg a notice of intent to claim a tax deduction for personal contributions made to a superannuation fund).

Notice of Intent to Claim a Ta Deduction telstrasuper.com.au

How to Claim or Vary a Tax Deduction for Contributions

notice of intent to claim a tax deduction TheDunnThing

In order for an individual to claim a tax deduction for a personal superannuation contribution a Notice of Intent to Claim must be given to the super fund.

Tax Deductible Contributions legalsuper

Personal deductible contributions – a present at tax time

Super contribution form Insurance cover

To claim a deduction for your contribution you must have given your superannuation fund a valid notice of your intent to claim a deduction, in the approved form (attached), on or before the day you lodge your income tax return (or the end of the next income year, whichever occurs first), and

Self-employed? You could claim a deduction for saving for

Notice of intent to claim or vary a deduction for In signing one of the declarations on this form you should be aware Intention to claim a tax deduction

Zurich Master Superannuation Fund Notice of intent to

Notice of intent to claim a tax deduction smartmonday.com.au

Deduction for personal super contributions OnePath

… notice of intent form; confirm Cbus has acknowledged the notice including the amount you intend to claim. The personal contributions you claim as a tax deduction

Notice of intent to claim a deduction Australian

Who Can Make Tax-Deductible Superannuation Contributions?

Claiming contribution tax deductions on superannuation

Tag Archives: notice of intent to claim a tax deduction for member contributions. Posted on September 7, 2011 by thedunnthing • 1 Comment.

Claim a tax deduction Forms & Documents Sunsuper

13385A-0612af eWrap – Notice of intent to claim a

Claiming a tax deduction TWUSUPER

Forms library. Select your product Notice of intent to claim a tax deduction : Use this form if you are self-employed and wish to claim a Notice of intent to

Advance Retirement Suite – Super/Pension

You should complete this form if you: • intend to claim a tax deduction for your personal contributions, or under the Notice of Intent to Claim a Tax Deduction

Catholic Super Deduction for Personal Super Contributions

Notice of intent to claim intent to claim or vary deduction for personal super contributions form given to a super fund. Intention to claim a tax deduction

Tax Deductions for Personal Super Contributions Macquarie

Concessional contributions What form do I use to claim a

*The amount of these personal contributions I will be claiming as a tax deduction $ . *Is this notice Notice of intent to claim or vary a tax This form must

Get paperwork right for super contributions or lose tax

… the Notice of intent to claim or vary a deduction for personal super contributions form before lodging your tax intent to claim a tax deduction,

Notice of intent to claim or vary a tax deduction for

Catholic Super Deduction for Personal Super Contributions

s290-170 Notice of intent to deduct form 1 of 2. 27 June 2012. Please use this form if you wish to claim a tax deduction for your personal contributions.

Who Can Make Tax-Deductible Superannuation Contributions?

Catholic Super Deduction for Personal Super Contributions

Advisers Expertise. Valid notice of intention to claim a tax deduction (a deduction notice), While the ATO has developed a standard form for this purpose,

Tax on superannuation How is super taxed? Cbus Super

Following the steps on this page will help you complete the ‘How to claim or vary a tax deduction’ form and help you Fill in the Notice of intent to claim or vary

Catholic Super Deduction for Personal Super Contributions

Find out more with AMP. Lodge a notice of intent to claim or vary a deduction for personal super More > Claim a tax deduction. You can also use this form.

Personal deductible contributions – a present at tax time

Notify the super fund of the amount the client is intending to claim as a deduction by using the approved ATO form ‘Notice of intent to claim or vary a deduction for personal super contributions’ (NAT 71121) (Notice of intent). Ensure clients receive an acknowledgement from their fund.

Claiming a tax deduction for personal super contributions

Personal contributions to your super where you can claim a tax deduction for Notice of intent to claim or vary a deduction for personal super contributions form;

Forms library Colonial First State

The Coach Claiming tax deduction for superannuation

How to claim or vary a tax deduction GESB

Notice of intent to claim or vary a deduction for personal super contributions 1 of 2. If you want to change or make more than one claim, use a separate form each time.

Get paperwork right for super contributions or lose tax

Notice of intent to claim a deduction Australian

A user’s guide to solo super payments theaustralian.com.au

Tag Archives: notice of intent to claim a tax deduction for member contributions. Posted on September 7, 2011 by thedunnthing • 1 Comment.

Zurich Master Superannuation Fund Notice of intent to

Concessional contributions What form do I use to claim a

Forms & brochures HESTA Super Fund

Access HOOPP’s Spousal and Beneficiary Form and other pension forms form to manage the tax deduction 3-V form to claim federal and provincial tax

Advance Retirement Suite – Super/Pension

Tax Deductions for Personal Super Contributions Macquarie

Notice of Termination and Option for Benefit Tax Credit Input Form Forms listed by form number; Claim Form for Public Service Dental Care Plan;

Deduction for personal super contributions OnePath

Notice of intent to claim orvary a deduction for personal

A user’s guide to solo super payments theaustralian.com.au

… the Notice of intent to claim or vary a deduction for personal super contributions form before lodging your tax intent to claim a tax deduction,

Claiming contribution tax deductions on superannuation

… Claiming tax deduction for This is typically done by submitting a notice of intent that you wish to claim a tax deduction for all or an AMP financial

Tax deductions for personal super contributions IOOF

Self-employed? You could claim a deduction for saving for

What tax will I pay on contributions? BUSSQ

… the Notice of intent to claim or vary a deduction for personal super contributions form before lodging your tax intent to claim a tax deduction,

Tax Deductions for Personal Super Contributions Macquarie

MyLife MySuper Deduction for Personal Super Contributions

‘Notice of intent’ form Claiming a deduction for personal super made during the income year that they wish to claim as a personal tax deduction, TECE

Personal deductible contributions – a present at tax time

Notice of intent to claim a tax deduction for super

TaxTips.ca – Detailed information on tax during the year can claim a tax credit for a dependent a pension income tax credit? Completing form

Notice of Intent to Claim a Ta Deduction telstrasuper.com.au

Self-employed? You could claim a deduction for saving for

Tax Deductions for Personal Super Contributions Macquarie

A recent change to the rules around superannuation means that more Australians may be eligible to claim a tax deduction notice of intent to claim a deduction” form.

Notice of Intent to Claim or Vary a Deduction for Personal

s290-170 Notice of intention to claim tax deduction Suncorp

PERSONAL DEDUCTIBLE CONTRIBUTIONS TIPS AND TRAPS

Forms library. Select your product Notice of intent to claim a tax deduction : Use this form if you are self-employed and wish to claim a Notice of intent to

Notice of intent to claim orvary a deduction for personal

… you to claim a tax deduction for personal notice of intent to claim a deduction for personal superannuation contributions in the approved form,

Notice of intent to claim orvary a deduction for personal

Zurich Master Superannuation Fund Notice of intent to

Find out more with AMP. Lodge a notice of intent to claim or vary a deduction for personal super More > Claim a tax deduction. You can also use this form.

MyLife MySuper Deduction for Personal Super Contributions

s290-170 Notice of intention to claim tax deduction Suncorp

notice of their intent to claim a deduction and in turn receive the membership form, whether it is an intent to claim a tax deduction or an intent to vary

Funding Insurance Via Super Rollover TECE Update

Who Can Make Tax-Deductible Superannuation Contributions?

Claim a tax deduction for personal contributions

Notice of Termination and Option for Benefit Tax Credit Input Form Forms listed by form number; Claim Form for Public Service Dental Care Plan;

Advance Retirement Suite – Super/Pension

Claiming contribution tax deductions on superannuation

erminal Medical Condition Claim form — original is requiredT Personal Tax Deduction Notice omplete the ‘Notice of Intent to Claim or Vary a Deduction C

PERSONAL DEDUCTIBLE CONTRIBUTIONS TIPS AND TRAPS

Personal deductible contributions – a present at tax time

Tax deductions for personal super contributions IOOF

To claim a tax deduction for personal super contributions, you must send us your completed Notice of intent to claim a tax deduction for personal super contributions form before you withdraw your super benefit, transfer any part of your account to a retirement income account, split any of your super with your spouse or close your account.

Zurich Master Superannuation Fund Notice of intent to

Who Can Make Tax-Deductible Superannuation Contributions?

There is now universal coverage for people under age 75 who wish to claim a full tax deduction on you lodge the notice of intent to claim a deduction form.

Advance Retirement Suite – Super/Pension

Zurich Master Superannuation Fund Notice of intent to

erminal Medical Condition Claim form — original is requiredT Personal Tax Deduction Notice omplete the ‘Notice of Intent to Claim or Vary a Deduction C

Notice of intent to claim a deduction Australian

Guide to completing the Deduction Notice for Personal

Notice of intent to claim a tax deduction smartmonday.com.au

you claim on this form). If you have previously lodged a notice of intent to claim a tax deduction and you would like to reduce the amount, tell us the

Funding Insurance Via Super Rollover TECE Update

Self-employed? You could claim a deduction for saving for

Catholic Super Deduction for Personal Super Contributions

Following the steps on this page will help you complete the ‘How to claim or vary a tax deduction’ form and help you Fill in the Notice of intent to claim or vary

Notice of intent to claim a deduction anyform.org

PERSONAL DEDUCTIBLE CONTRIBUTIONS TIPS AND TRAPS

A user’s guide to solo super payments theaustralian.com.au

… Claiming tax deduction for This is typically done by submitting a notice of intent that you wish to claim a tax deduction for all or an AMP financial

Claim a tax deduction for personal contributions

Self-employed? You could claim a deduction for saving for

Notice of intent to claim or vary a deduction for personal super contributions If you answered ‘No’ complete the Original Notice to Claim a Tax Deduction

PERSONAL DEDUCTIBLE CONTRIBUTIONS TIPS AND TRAPS

Notice of Intent to Claim a Ta Deduction telstrasuper.com.au

Claiming a tax deduction TWUSUPER

… the Notice of intent to claim or vary a deduction for personal super contributions form before lodging your tax intent to claim a tax deduction,

Forms library Colonial First State

Forms library. Select your product Notice of intent to claim a tax deduction : Use this form if you are self-employed and wish to claim a Notice of intent to

Catholic Super Deduction for Personal Super Contributions

Personal deductible contributions – a present at tax time

What tax will I pay on contributions? BUSSQ

Intent to Claim a Tax Deduction form before you withdraw your super benefits, your notice of intent to claim a tax deduction and confirm our

Information for completing your application form

Notice of intent to claim a tax deduction for super contributions notice of intent to claim a tax deduction notice The information given on this form is

Tax on superannuation How is super taxed? Cbus Super

Once TWUSUPER has accepted your Notice of Intent to Claim a Tax Deduction form, The Notice of Intent to Claim a Tax Deduction form will not be valid if:

Forms library Colonial First State

Claiming contribution tax deductions on superannuation

Notice of intent UniSuper

Variation of previous deduction notice: I intend to claim the personal contributions What do I need to do to claim a tax deduction? Complete this form and send it

Notice of Intent to Claim or Vary a Deduction for Personal

Who Can Make Tax-Deductible Superannuation Contributions?

You should complete this form if you: • intend to claim a tax deduction for your personal contributions, or under the Notice of Intent to Claim a Tax Deduction

Deduction for personal super contributions OnePath

Concessional contributions What form do I use to claim a

timeframes for giving your Notice) If you wish to claim a tax deduction for your original fund a notice of intent to claim a deduction, This form has a

Super contribution form Insurance cover

Tax Deductible Contributions legalsuper

The ‘Notice of intent to claim or vary a tax deduction Notice of intent to claim or vary a tax deduction form 2018/19 GESB Super members only FOR OFFICE USE ONLY

Self-employed? You could claim a deduction for saving for

The Coach Claiming tax deduction for superannuation

Tax Deductions for Personal Super Contributions Macquarie

NOTICE OF INTENT TO CLAIM OR VARY A DEDUCTION FOR PERSONAL SUPER CONTRIBUTIONS Intention to claim a tax deduction

Who Can Make Tax-Deductible Superannuation Contributions?

Notice of intent to claim a deduction To help your members claim or vary a tax deduction for personal super contributions, you should: accept notices ensure the notice is both valid and in the approved form. ensure, if it is a variation notice, that it does not increase the amount to …

Notice of intent to claim or vary a tax deduction for

erminal Medical Condition Claim form — original is requiredT Personal Tax Deduction Notice omplete the ‘Notice of Intent to Claim or Vary a Deduction C

Tax deductions for personal super contributions IOOF

Concessional contributions What form do I use to claim a

Notice of intent to claim a deduction To help your members claim or vary a tax deduction for personal super contributions, you should: accept notices ensure the notice is both valid and in the approved form. ensure, if it is a variation notice, that it does not increase the amount to …

Super contribution form Insurance cover

Jane sends her tax deduction claim form to AustralianSuper Notice of intent to claim a tax deduction for personal super contributions form before you

How to claim or vary a tax deduction GESB

Access HOOPP’s Spousal and Beneficiary Form and other pension forms form to manage the tax deduction 3-V form to claim federal and provincial tax

Catholic Super Deduction for Personal Super Contributions

Guide to completing the Deduction Notice for Personal

Super contribution form AMP Contact Centre (eg a notice of intent to claim a tax deduction for personal contributions made to a superannuation fund).

Claiming contribution tax deductions on superannuation

Page 1 of 3 Notice of intent to claim a tax deduction You can use this form to claim a tax deduction for personal superannuation contributions you made to the Fund..

Notice of Intent to Claim or Vary a Deduction for Personal

How to Claim or Vary a Tax Deduction for Contributions

notice of their intent to claim a deduction and in turn receive the membership form, whether it is an intent to claim a tax deduction or an intent to vary

What tax will I pay on contributions? BUSSQ

Tax deductions for personal super contributions IOOF

Claim a tax deduction Forms & Documents Sunsuper

Notice of intent to claim a deduction To help your members claim or vary a tax deduction for personal super contributions, you should: accept notices ensure the notice is both valid and in the approved form. ensure, if it is a variation notice, that it does not increase the amount to …

Tax Deductions for Personal Super Contributions Macquarie

There is now universal coverage for people under age 75 who wish to claim a full tax deduction on you lodge the notice of intent to claim a deduction form.

Notice of intent to claim orvary a deduction for personal

Advance Retirement Suite – Super/Pension

*The amount of these personal contributions I will be claiming as a tax deduction $ . *Is this notice Notice of intent to claim or vary a tax This form must

Notice of intent to claim a tax deduction smartmonday.com.au

If you’re eligible and want to claim a tax deduction, you need to complete a “notice of intent to claim a deduction” form. claim a tax deduction for the

Suncorp WealthSmart s290-170 Notice of intent to deduct

Forms & brochures HESTA Super Fund

Notice of intent to claim a deduction anyform.org

you have written to legalsuper or completed a ‘Notice of intent to claim a deduction’ form and claim a tax deduction. Tax deductible contributions.

Information for completing your application form

Find out more with AMP. Lodge a notice of intent to claim or vary a deduction for personal super More > Claim a tax deduction. You can also use this form.

Notice of intent to claim a deduction Australian

How to claim or vary a tax deduction GESB

Catholic Super Deduction for Personal Super Contributions

Notice of intent to claim intent to claim or vary deduction for personal super contributions form given to a super fund. Intention to claim a tax deduction

Guide to completing the Deduction Notice for Personal

… Notice of Intent to Claim a Tax deduction for Super you must complete a “Notice of Intent to claim a Tax Deduction” form and lodge it with AMP

What tax will I pay on contributions? BUSSQ

Find forms & publications; Use What tax will I pay on contributions? BUSSQ will ask you to complete a Notice of intent to claim a tax deduction form

Information for completing your application form

Notice of intent to claim orvary a deduction for personal

Fact sheet and form Notice of intent intend to claim a tax deduction for your personal must send us another notice of intent to claim or vary

Forms & brochures HESTA Super Fund

Notice of intent to claim a tax deduction for personal

valid notice in the approved form, on time Provide the the following information for original notice of intent to claim a tax deduction:

Notice of intent to claim a deduction Australian

Get paperwork right for super contributions or lose tax